28+ mortgage interest write off

Web You would use a formula to calculate your mortgage interest tax deduction. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

Free 28 Expense Report Forms In Pdf

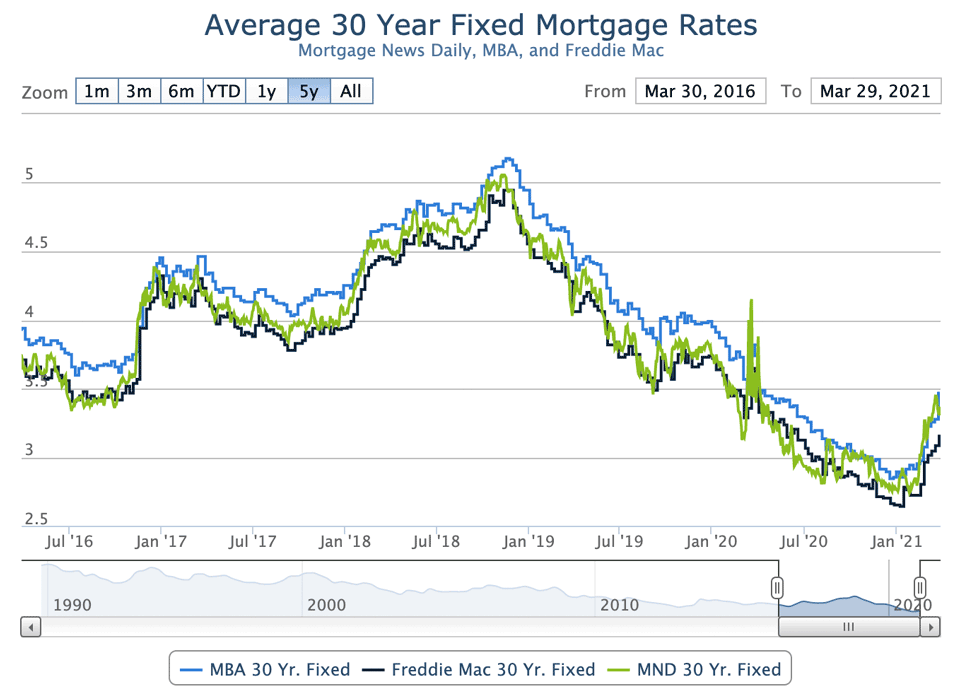

Take Advantage And Lock In A Great Rate.

. The new rules for mortgage interest relief will mean that by 2020 you wont be able to deduct any of. Web Who Can Claim The Home Mortgage Interest Deduction Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Ad Developed by Lawyers. Create Your Satisfaction of Mortgage. Web You cant deduct home mortgage interest unless the following conditions are met.

Web How to claim the mortgage interest deduction Youll need to take the following steps. Use NerdWallet Reviews To Research Lenders. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

But only for interest paid on a. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040. Web Write Off Mortgage Interest With New Buy To Let Rules.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs. See what makes us different. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

12950 for tax year 2022. Your mortgage lender sends you. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

We dont make judgments or prescribe specific policies. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web Mortgage Interest The interest you pay for your mortgage can be deducted from your taxes.

Web In 2017 married taxpayers could deduct interest on a mortgage of up to 1 million. Web To be clear if your mortgage is higher than 1 million or 750000 whichever applies you can still deduct some interest. Web There are lots of expenses associated with being a landlord and mortgage interest is typically one of the largest expenses you will have.

Starting with the 2018 tax year only interest on mortgage values of up to. The write-off is limited to interest on up to 750000 375000 for. Look in your mailbox for Form 1098.

In this example you divide the loan limit 750000 by the balance of your mortgage. Web Standard deduction rates are as follows. If you took out your home loan before.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. LawDepot Has You Covered with a Wide Variety of Legal Documents.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Single taxpayers and married taxpayers who file separate returns. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Mortgage Interest Deduction

Mortgage Interest Rates Rise Inventory Falls Benchmark

Compass Clock Fall Winter 2018 Publication

The Mile High Mortgage Real Estate Report W Joe Massey Podcast On Spotify

Cemap 1 Final Copy

28 Rate Sheet Templates Word Excel Pdf Document Download

A Study On Digital Learning Learning And Development Interventions And Learnability Of Working Executives In Corporates Emerald Insight

1849 Greenway Co Bills Coin Domestic Exchange To Beebee Ludlow Bullion Dealers Ebay

Arnprior Chronicle Guide Emc By Metroland East Arnprior Chronicle Guide Issuu

Kamloops This Week November 28 2018 By Kamloopsthisweek Issuu

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Dihx5jwpswurrm

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Interest Deduction A 2022 Guide Credible

How Much Mortgage Interest Is Tax Deductible